The COVID-19 global pandemic has forced the banking and financial markets to reshape how they do the business. Daily operations and business processes have been impacted by the shift to remote, online work. In addition, the financial services industry is facing significant declines in market capitalization while addressing the new challenges like lower interest rates and increased lending volumes with higher default risk, which reduces revenues. At the same time, transaction volumes are down due to global liquidity and lending supply narrowing, which leads to lower fees collected from transactions.

So, banks are figuring out how they can best survive during the pandemic and be prepared for the new way of the world. Digital transformation is no longer an option, but a necessity and some banks may not be prepared for online banking adoption. Also, this shift to digital interactions is forcing banks to reinvent customer relationships. Without face-to-face interaction, banks must leverage technology to give customers the same consistent experience.

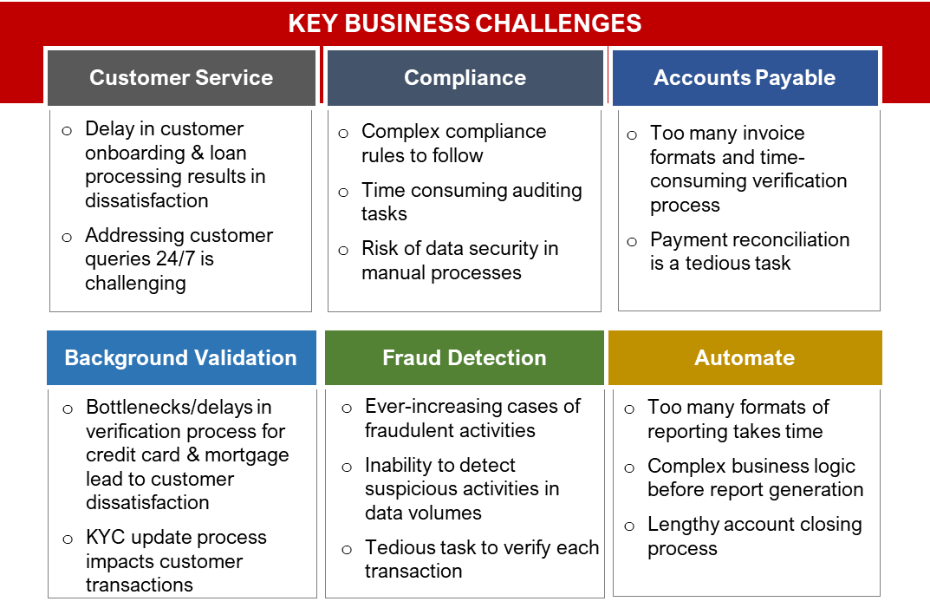

Evaluate your existing challenges:

Banks also need to relook the existing business processes and refix the broken or inefficient processes whether that’s in opening accounts, onboarding a new customer, even setting up a product or service. The customer needs to know that they’re being taken care of, that their needs are being met.

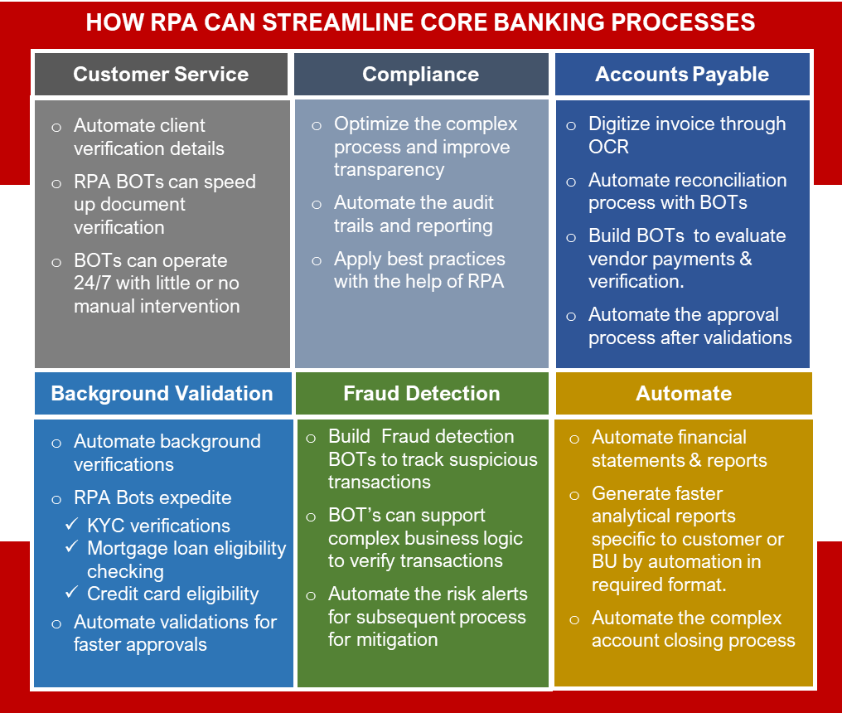

How can Automation with RPA BOTs fill the gap?

There are a variety of technologies that banks can evaluate to address the shortfalls of manual interactions with business processes that serve their customers. RPA (Robotic Process Automation) is one such technology that has the ability to build software robots that essentially replace tedious, manual, repetitive tasks by automating simple tasks and freeing up employees to complete higher value work.

Automate the key business processes:

Overall business benefits:

- Expediting Operational efficiency: Allowing RPA to accomplish high volume actions with 100% accuracy by eliminating human error.

- Employee Experience: Employees can focus on higher value work by allowing RPA to complete repetitive, mundane tasks.

- 100 % Customizable: RPA captures data the same way as a human would interact with a software, website, or an application.

- Improve Business response time: BOT never sleeps — high volume tasks can be accomplished round the clock with a higher degree of accuracy.

Conclusion: Competition amongst banks will be fierce as consumers evaluate their banking options. Early adopters will gain a competitive advantage over that of slow adopters. Intelligent automation solutions can assist organizations in successfully driving value throughout these challenging times, and amid the opportunities they present.

RPA can provide the edge over competition with reduced cost and improved efficiency and considering the value it gives to your business, you can surely get a good ROI within months of investment. It’s time you switch to smart banking operations.

If you want to learn more about RPA and how it can be leveraged in banking, connect with us and join our on-demand series of webinar ‘Rapid Digital Transformation Journeys’. We are partnered with UiPath for automation solutions and out we can help empower your team to drastically cut down processing times and provide a better experience for clients.